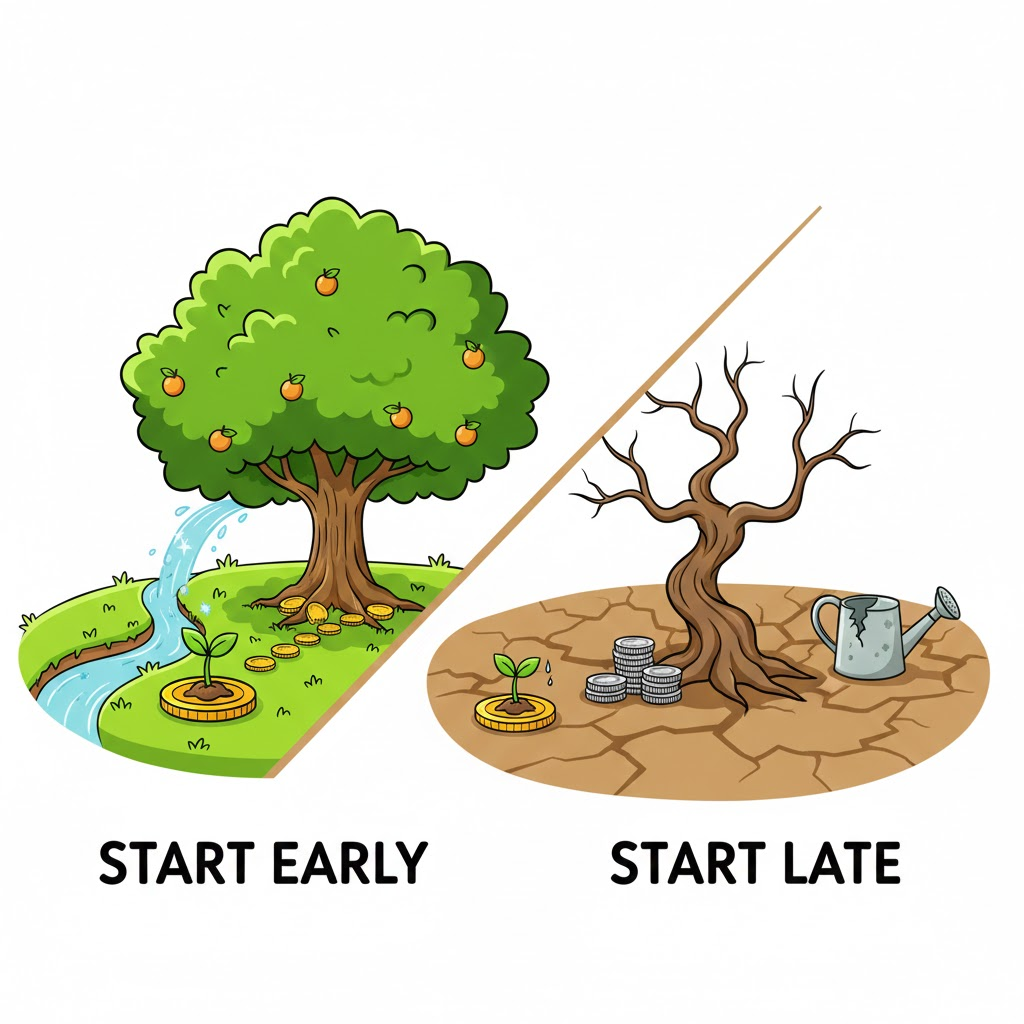

We’ve all heard the old proverb: “The best time to plant a tree was 20 years ago. The second best time is today.” In the world of building wealth, this isn’t just a poetic sentiment—it is a mathematical law.

When it comes to your financial future, the most valuable asset you own isn’t your current salary or your bank balance. It’s your time.

What is Compounding, Really?

Albert Einstein famously called compound interest the “eighth wonder of the world.” While simple interest pays you a flat fee based on your original deposit, compounding is the process where your earnings begin to earn their own earnings.

It creates a powerful snowball effect that moves through three distinct stages:

- The Contribution Phase: You put money in. It feels small, and the growth feels slow.

- The Accumulation Phase: Your money earns interest. You start to see the balance tick up beyond just what you’ve deposited.

- The Acceleration Phase: The interest earned in Phase 2 begins to earn its own interest. This is where the “snowball” starts rolling down the hill on its own.

The Math of Waiting: Aria vs. Ben

Many people wait for the “perfect” market conditions or until they have a “significant” amount of money to invest. However, the “Wait-and-See Tax” is the most expensive fee you will ever pay.

Let’s look at two investors, both earning a 7% annual return:

- Aria starts at age 25. She invests $500 a month but stops entirely after just 10 years (at age 35). She never adds another cent.

- Ben waits until age 35 to start. He invests the same $500 a month, but he does it for 30 years straight until he turns 65.

The Result: Even though Ben invested $180,000 (3x more than Aria’s $60,000), Aria still ends up with more money at retirement (~$602,000 vs Ben’s ~$540,000).

The Lesson: You cannot out-earn a late start. Time does the heavy lifting so your paycheck doesn’t have to.

The Psychology of the “Slow Start”

The reason most people don’t invest early is that compounding is back-loaded. In a 30-year investment horizon, the majority of your total gains often happen in the last 5 to 10 years.

This leads to “The Valley of Disappointment,” where you feel like your investments aren’t “doing anything” in the first few years. But just like a plane uses the most fuel during takeoff, your investments need that early energy to reach the cruising altitude where growth becomes effortless.

How to Start (Even with $50)

You don’t need to be a “high net worth individual” to benefit from compounding. You just need to be consistent.

- Automate It: Set up a recurring transfer. If you don’t see the money, you won’t miss it.

- Increase Gradually: Start with what you can afford, and increase your contribution by 1% every time you get a raise.

- Think in Decades: Ignore the daily news cycle. Compounding is a marathon, not a sprint.

Bottom Line: The Clock is Ticking

The market doesn’t care how smart you are, but it cares deeply about how long you’ve been there. Every day you wait is a day of exponential growth you can never get back.

What is one small amount you can commit to investing today to jumpstart your snowball?