Our Mission

We exist to empower people at every stage of life to confidently shape their financial future, providing clear and actionable guidance that makes the complex simple, rooted in timeless principles and sustainable long-term strategies, with unwavering partnership throughout the journey.

What Drives Us

Accountability

Building trust is the foundation of every client relationship. We cement this trust through perpetual ownership of our decisions.

Integrity

We hold ourselves to the highest standard of client care and professional excellence.

Transparency

No hidden fees, no hidden agenda, no complexities – just clarity on your path towards financial well-being.

Collaboration

We empower our clients to take part in the process by ensuring they are always heard.

Education

We talk with our clients, not past them. The more clients fundamentally understand their plan and investments, the better.

Invest Today. Thank Yourself Later.

Hi, I’m Jake and I’m invested in you!

My investing journey began like most: with very little to invest, but with very big dreams.

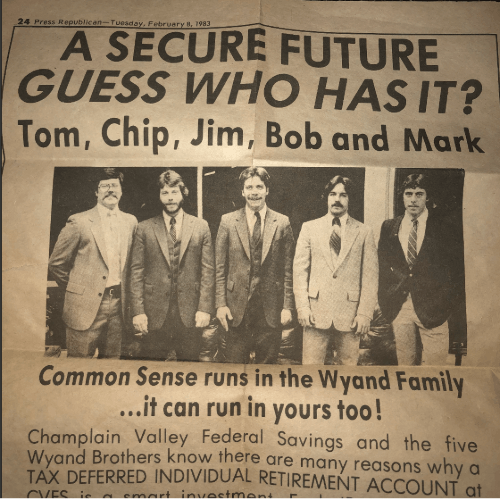

From a young age, I was fascinated with the idea of financial freedom. That fascination began with my early influences, including my Dad and his band of entrepreneurial brothers (nine of them, to be exact.) Together, they built numerous successful businesses from scratch, and I was fortunate enough to work alongside them in many of those ventures. Those experiences taught me invaluable lessons about money. Lessons I now feel called to share with everyone I cross paths with.

Money has Energy

Everything in the universe is energy, money is no exception. The energy you give money dictates how it flows in your life. When you approach it with gratitude, generosity, joy and purpose, money flows toward you. Display fear, greed, desperation, or anger, and money will be stuck within or repelled from your life.

Money has Intention

Money itself is neutral, it takes on the intention you give it. If your intention is freedom, impact, or love, money becomes a tool of benefit for this purpose. If your intention is rooted in ego, control, or proving something to others, money becomes a trap that never feels like enough.

Money has Untapped Potential

Most see money as a tool for consumption, but its higher purpose and potential is transformative. It can multiply through smart investing, it can buy back your time, it can fund your life’s work instead of just your survival. Give it a job, give it a purpose.

These three money mantras became the foundation for my life. As soon as I was legally able, I entered the workforce, scrimping and saving every dollar I earned, ensuring my money was vibrating at a high frequency (energy), given a clear and positive intention (freedom), and a higher purpose through investing (potential). It took time and sincere effort, as all meaningful things do, but through these actions, I was able to break free from my corporate job. Financial freedom was achieved, but my life’s mission was just beginning. That mission became Wyand Wealth.

The Wyand brothers bestowed upon me a wealth of knowledge with their money mindset. Now, it is my life’s work to do the same with each of my clients. Together, let’s build the financial future of your dreams, step-by-step, day-by-day through positive incremental actions. It is my honor to walk alongside you on your journey, wherever it may lead.

Working With Us

We Grow With Our Clients

At Wyand Wealth, our growth is naturally tied to yours. As a fee-only fiduciary, we have removed the conflicts of interest that hinder many financial relationships. This creates a true symbiosis: we do better only when you do better. Because we are legally and ethically bound to put your interests first, every recommendation we make is rooted in one single objective—your flourishing.

We do not accept commissions or hidden kickbacks from third parties, ensuring our advice remains objective.

Discovery –> Define –> Design –> Deploy

Who We Serve

We believe to our core that investing is for everyone

We proudly work with clients across the entire financial spectrum

First-Step Investors

Just getting started or not sure where to start? It can be confusing and overwhelming, we get it. We meet you where you are, taking the time and care to ensure you’re ready and comfortable to step into the journey of a lifetime. Your bright future awaits

Wealth Accelerators

Looking to supercharge your current savings or portfolio? We got you! We build a customized financial plan and investment strategy tailored to you and your needs. The road to financial freedom is closer than you think–let us show you the way.

Financial Freedom Club

We turn your portfolio into a paycheck, whether you’re still working or long since retired. We help you restructure your investments to generate reliable, growing income so you can live life off your returns on your terms, spending more time on what matters most to you.